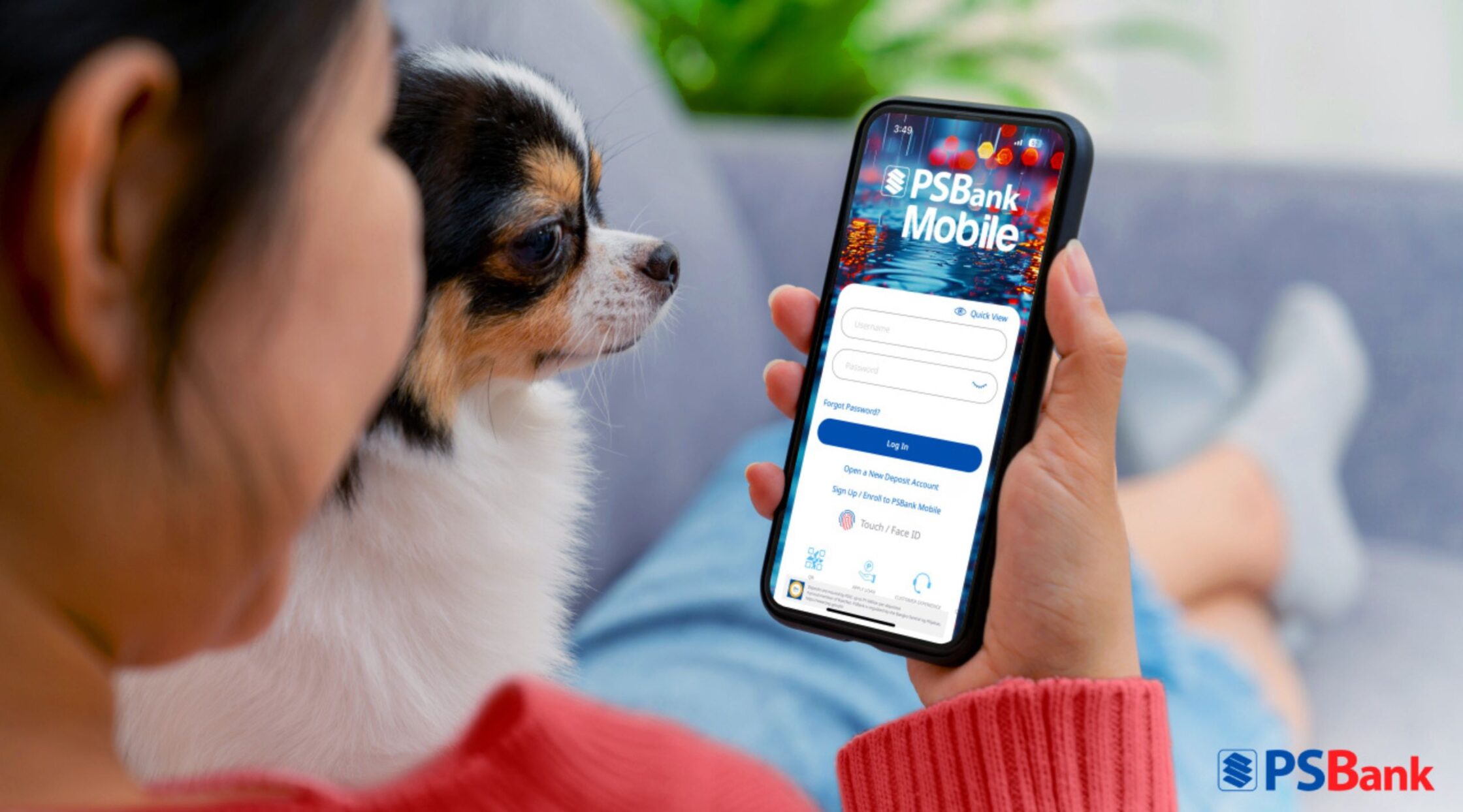

6 Things PSBank Mobile Makes Convenient For Families

Here’s how PSBank Mobile makes managing money more hassle-free for families

Some things are better done indoors—mobile banking being one of them nowadays! No need to wait for available ATMs and tellers or fill things in triplicate for simple banking processes—mobile banking puts everything together in an app like a one-stop shop. With everything organized, it’s less for parents to keep track of. Especially with the PSBank Mobile app, we can easily achieve all our daily banking needs within the comforts of our own home. All we need is a secure internet connection!

Here are six things PSBank Mobile makes more convenient for families!

Paying Bills

Long lines and app-switching are things of the past. With PSBank mobile, everything can be done within the app. Enroll the billers, schedule the payments — the only thing parents need to do is make sure there’s enough money in the account to pay for the bills.

Utilities, school fees, loans, real estate, app subscriptions — everything can be paid from PSBank Mobile. And if we need a record, all we have to do is check the transaction records and screenshot the exchange to send over the reference number if needed.

Reloading Toll RFID

Can’t remember if we reloaded our RFID Toll wallets? That’s the good part about PSBank; parents can enroll their EasyTrip and Autosweep RFID accounts to load up wherever and whenever. That way, travels can proceed smoothly and as planned.

Sending money

“Mom/Dad, I need money for (insert thing here)!” — whenever our kids scream that, we’re always freaking out, “How will I send my kids money?”

Kids have a knack for springing surprise expenses—right before the deadline. With PSBank Mobile, you can send money anytime via InstaPay or PESONet, or just scan a QR code. Crisis averted, no bank runs (or parental panic) required.

Locking or Unlocking Your ATM Card

Whether we want to curb the urge for a little “retail therapy,” our cards have been stolen, or we’ve simply misplaced them, PSBank Mobile lets parents lock and unlock their ATM cards anytime. No need to call the bank’s customer service hotline to block an account.

And once we have our cards back, we can unlock them again through the app.

Starting a Mobile Time Deposit Account

Make money work for us, not the other way around. Since savings accounts don’t usually have big interest rates, moving some of those funds into a mobile time deposit will help get things “moving.” While we won’t be able to use the money for the next 30, 60, or 90 days, it’ll earn more while it’s in a Mobile Time Deposit Account.

Easily get started with a minimum of PHP 10,000.00 and watch that money steadily grow.

Depositing Checks

While many of the young generation prefer online banking, older business accounts or old landlords still prefer checks—and depositing them can feel like a hassle. Not anymore—PSBank mobile allows users to deposit checks online. Simply take a photo, submit it through the app, and wait for confirmation.

PSBank Mobile: Making Money Management Hassle-Free

Before mobile banking, parents would desperately carve out time out of their busy schedules to sit down and deal with their accounts. Whether it’s time deposits, balancing the family budget, or making sure all utilities have been paid for, these things—though necessary—were no parents’ or adults’ favorite way to spend time (unless they’re accountants).

And with PSMobile Banking, the time spent dealing with those money matters will be a lot shorter and a lot less stressful. Besides, if parents want to teach their kids early on how the world handles money nowadays, mobile banking is where it starts.

Download the PSBank Mobile App today via the Apple App Store, Google Play Store, or Huawei AppGallery. For more information on PSBank’s products and services, visit psbank.com.ph or follow PSBank on Facebook.

More about online banking?

How The PSBank Mobile App Makes Summer More Fun

Investing In A Property? Here’s What You Need To Know

14 Ways to Teach Kids About Money And Finance Management